End of month billing can be a daunting prospect, and there is no guarantee of on-time payment. However, by improving your billing workflow there is a greater chance of having a healthier cash flow. Here are some ways you can improve your invoicing processes.

One of the most important things is your Terms and Conditions of Trade.

Firstly that you have them, and they are up to date.

Secondly, they outline your payment terms up-front. The best practice is to get your customer to sign your estimate (together with your Terms on the reverse) before starting the job.

Did you know?

Due analysed over 250,000 invoices sent over the past year and found if you put terms on your quotation and invoice, you are 1.5x more likely to get paid on time.

Research also shows that you are 3x more likely to get paid if you add a company logo to your documentation.

Our team are on hand to assess your current Terms and Conditions of Trade and advise if there are any tweaks you need to make. We can provide an assessment within 5-working days.

Contact us to find out more.

Implementing a 50% despot on a job before the work begins will bolster your cash flow.

Put simply, if you are targeting 50% gross profit percentage, you will have covered all your costs at the start of the job.

Remember: A deposit upfront ensures trust and relieves some of the risks of non-payment. You need to establish trust with the prospect to get money upfront.

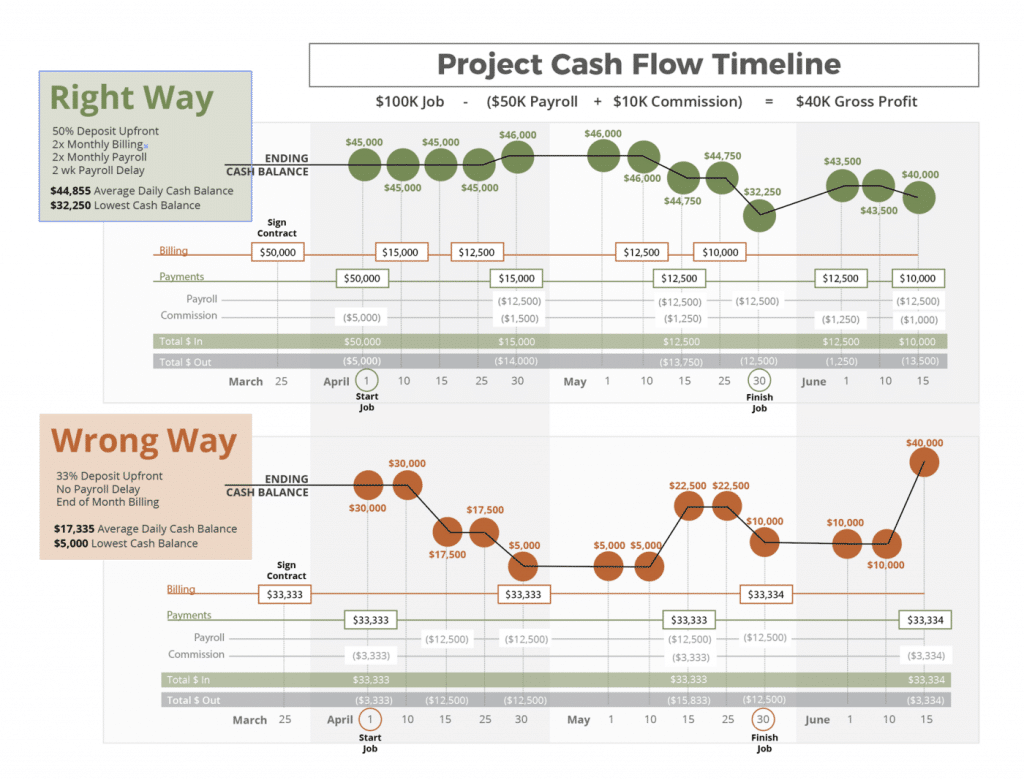

Tweaking a couple of things can make a positive impact on your cash flow. One is getting cash from your customer before having to pay payroll-related costs for that project.

It may not always be possible but you can shrink the time between when you get paid and when you have to pay payroll. This has a material impact on cash flow. The bigger and more successful you are, the more important that becomes. Why? Bigger companies need more cash to survive and the cash flow risks are greater.

Whether you’re a $500,000 company or a $5 million company, you have to make every payroll. A big reason why so many small businesses fail is that they spend their time chasing cash to make the next payroll.

The graph above shows by getting a larger deposit upfront and delaying payroll two weeks, you can more than double your average cash balance. If you did that on every job, it’s huge for a small business!

How often do you send out your invoices?

Cashflow forecasting software Vistr analyzed 300,000+ invoices and found that a lot of companies invoice as jobs come in. While it’s good practice to invoice as soon as you reach key invoicing milestones, it can be inefficient. The key takeaways from the research were:

You can improve your cash flow significantly, as invoices sent on weekends are generally paid within 29 days, a full 10 days faster than invoices sent on Tuesdays, Thursdays, and Fridays. As for the monthly invoicing, invoices issued on the 1st day of the month was paid in 30 days. Invoices issued on the 30th were paid in 38 days. By issuing an invoice on the 1st, you will improve your cash flow by getting paid a whole week faster!

Sign-up with us

Sign-up with us

In conclusion, your billing process is equally as important as the products and services you provide. Having the correct Terms and Conditions of Trade in place along with a robust workflow will greatly impact how your customers and prospects perceive you and build that trust that you are a reliable business.

Protecting your cash flow is something we specialise in and we are more than happy to come and visit you on-site for an obligation free chat on your current processes and work side by side with you to fine tune.

Request your call back

Request your call back

Thank you very much to the following publications for their content: GrowthForce, Scoro, Due, and Vistr.

(please include your contact details)

Melbourne, Sydney, Perth, Brisbane, Adelaide & Tasmania

EC Credit Control (Aust) Pty Ltd